The 5 Fastest Ways to Improve Your Credit Score

Taking the first steps on your financial journey can be tough. Take credit for instance. When you try to rent an apartment, finance a car, or take out a personal or student loan, you might find your application denied because your credit score is too low.

It takes time to build up your credit score, but how do you get started if no one will extend you a credit or a loan in the first place? And, what do you do if you need to rent an apartment or buy a car so you can attend school or start a new job?

Below we take a look at how credit scores work. We’ll consider specific things you can do to improve your credit score and how quickly these will reflect on your credit record. We also look at the immediate impact on your credit of making a major purchase or taking out a large loan.

And, we’ll suggest 5 key ways you can act now to boost your credit score ahead of a major purchase or loan application. Read on to learn more.

CREDIT CONUNDRUM: BOOSTING YOUR SCORE

Your credit score dictates how easily you’ll be able to borrow money or open accounts, as well as the interest rate you will pay on money you need to pay back. Your score is based on how you have handled credit in the past, as tracked by credit bureaus Experian, TransUnion, and Equifax.

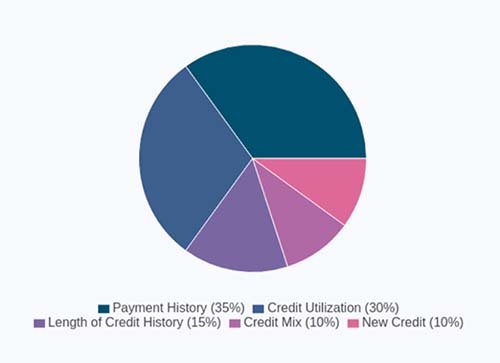

Lenders use a combination of measures to calculate your score. Many use the FICO® scoring system, which includes:

Your payment history (about 35%): Your track record of making payments on bills, credit cards, and loans consistently and on time, often over seven years or more.

Credit utilization (about 30%): The amount of your available credit on revolving credit lines (credit cards) you're using.

Length of credit history (about 15%): The total amount of time you have had credit accounts open, and how recently you've used them. The longer your history the better.

Credit mix (about 10%): Having a wide range of accounts such as credit cards, a car loan, and a mortgage, plays a small role in improving your credit score.

New credit (up to 10%): Lenders typically are concerned if you open up several new credit card accounts or take out new loans in a short period of time.

*Created using data published by Experian

Factors including your on-time payment record and the length of your credit history weigh heavily on your score, while even inquiring about new credit can lower it.

That makes it tough for younger borrowers to establish a credit score. Ideally, you’ll want to improve your score gradually over time, but when you’re just starting out, that can be challenging. So initially, you may need to have both a long-term strategy and a short-term plan to boost your credit score.

THE LONG GAME: SUSTAINABLE CREDIT BUILDING

The golden rule of sustainable credit building is to make debt payments on time to reinforce your payment history. Start with utility bills, online subscriptions, or a basic credit card. Pay consistently and you’ll see your credit score improve within 12-18 months.

Once you have one or more credit cards open in your name, it’s time to get smart with credit utilization. Make sure you are never using more than 30% of your limit on any one card, even for a short time. Organized borrowers should see consistent improvement in their score within 6-12 months.

Also remember to keep a mix of credit accounts open, even if you don’t use them. This takes organization and discipline, but it helps to lengthen your credit history and improve your credit mix over periods of 2-5 years.

BITING THE BULLET: PURCHASES AND LOANS

Unfortunately, very few of us have time to build up a sparkling credit score before we are faced with a major expense or unavoidable purchase for which we require financing through a loan or credit card. Here’s how your credit is likely to be affected and some things you can do about it.

First, don’t panic. While your credit score will take an initial hit if you need to take out a loan or open a new credit card, the effect should be small and relatively short term. If you use more than 30% of the limit on a new credit card, however, you may see a more substantial drop.

Provided you borrow within your limits, this is actually an opportunity to continue to improve your credit score. You can do this by making sure you continue to make payments on time and by working to bring your credit utilization on any credit card or line of credit below 30%.

5 WAYS TO IMPROVE YOUR CREDIT SCORE FAST

Thinking long-term is always smart, but what can you do if you need to improve your credit score quickly to finance an unavoidable expense like a car purchase or student loan? Let’s take a look at five things you can do to boost your credit score in the short term.

1. CHECK YOUR CREDIT REPORT

Access your full credit report from one or more of the big credit bureaus. You can access a free copy of your report here. Go through it carefully. You’re looking for:

Unpaid bills or fees

Unauthorized loans, accounts, credit cards, or lines of credit in your name

Other inaccuracies including your name, address, and employment details

Dispute any discrepancies with the relevant credit bureaus or the reporting vendor. The effect of resolved disputes should reflect on your credit report within 30-45 days.

2. PAY DOWN BALANCES

If you have outstanding balances on your credit cards or charge accounts, do whatever you can to pay these down–even if it means delaying your credit application by a few months. The lower you can get your credit utilization rate, the better.

The effect of lower balances should be visible in your credit report within a month.

3. ASK FOR HIGHER CREDIT LIMITS

While your ability to pay down outstanding balances may be limited, you might consider requesting a higher limit on your credit card, which would lower your credit utilization rate. A history of consistent, on-time payments may help convince your lender to raise your limit.

Higher credit card limits are usually reflected in a lower utilization rate within 30 days.

4. BE STRATEGIC ABOUT BALANCES

You can also improve your overall credit utilization rate by being smart about how you manage your card balances. Keep the portion of the limit you borrow on each card below 30% by spreading purchases between cards or by making extra payments each month.

Lower balances on multiple cards should reflect on your credit report in 1-3 months.

5. CONSIDER A BALANCE TRANSFER CARD

A balance transfer card allows you to consolidate existing balances on other cards onto your new card for little or no cost. Most cards also feature a low- or zero-interest introductory period. However, a balance transfer card should ideally have a lower rate than your existing cards.

A balance transfer card can help you:

Pay down outstanding balances faster, so you free up cash

Lower credit utilization rates across one or more cards

Lower your utilization rate by raising your credit limit with a new card

Many balance transfer cards also offer a cash or interest rate bonus if you charge a given amount to the card within the first few months. This can be a useful way to help cover the cost of a major purchase while reducing the impact on your credit.

Provided your new card improves your overall credit utilization rate, you should see an improvement in your credit score in 1-3 months. Remember to keep your old cards open even if you have paid them off to preserve the overall length of your credit history.

GET THE CREDIT YOU DESERVE WITH GHS FCU

Working to lower your credit fast may help you access a slightly lower interest rate on a loan or an improved APR on a credit card. While that is valuable—sustainable, long-term improvement of your credit is the result of consistency and careful planning over the long term.

At GHS FCU, we know that starting out is tough. That’s why we strive to build lasting relationships with our members and to provide them with quality financial products so that their hard work now continues to deliver dividends long into the future.

It’s why we offer valuable credit-building tools like our low-cost GHS Visa® Platinum Credit Card and flexible home equity lines of credit (HELOCs).

And, it’s also why we approach financial wellness as a core part of our mission to bring accessible affordable banking to our members and our communities. Our free financial wellness services include:

Personalized counseling from our Certified Financial Counselors

Financial wellness articles, webinars, and podcasts

Financial education events with partner organizations and community partners

Contact us today, or click below to learn how GHS FCU can help you make the changes today that will help you thrive financially long into the future.